Copywriter portfolioMy idea: Five pages for the cost of three.(Scroll down for description and copy)

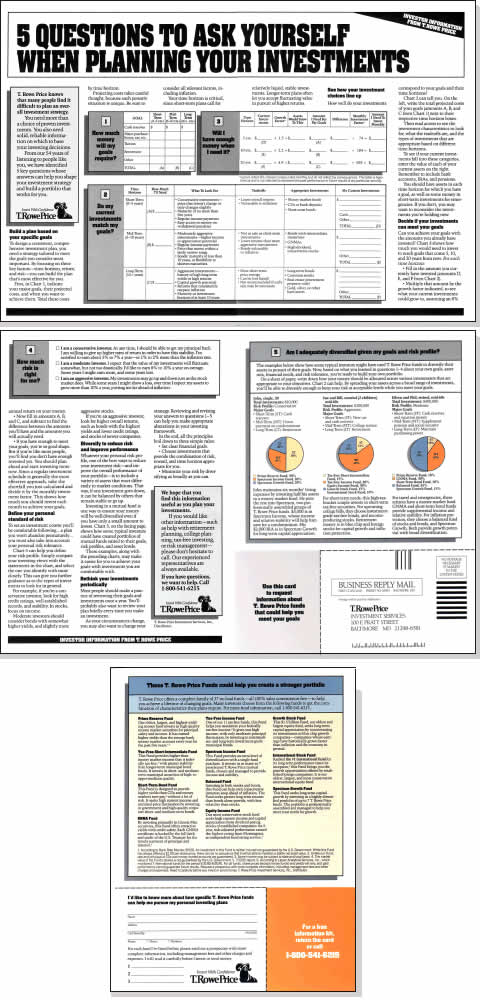

Media: 5-page ad (Originally to be a 3-page ad with BRC, but at my suggestion, and with surprisingly few more dollars, we enlarged the BRC to a full page, to include typical investor profiles, fund descriptions, and generous COPY:Headline: 5 Questions To Ask Yourself When Planning Your Investments Intro Box: T. Rowe Price knows that many people find it difficult to plan an overall investment strategy. You need more than a choice of proven investments. You also need solid, reliable information on which to base your investing decisions. From our 54 years of listening to people like you, we have identified 5 key questions whose answers can help you shape your investment strategy and build a portfolio that works for you. Body Copy:

Build a plan based on your specific goals To design a consistent, comprehensive investment plan, you need a strategy tailored to meet the goals you consider most important. By focusing on three key factors -- time horizon, return, and risk -- you can build the plan that's most effective for you. First, in Chart 1, indicate your major goals, their projected costs, and when ou want to achieve them. Total these costs by time horizon. Projecting costs takes careful thought, because each person's situation is unique. Be sure to consider all relevant factors, including inflation. Your time horizon is critical, since short-term plans call for relatively liquid, stable investments. Longer-term plans often let you accept fluctuation value in pursuit of higher returns. See how your investment choices line up How well do your investments correspond to your goals and their time horizons? Chart 2 can tell you. On the left, write the total projected costs of your coals amounts A, B, and C from Chart 1) next to their respective time horizon boxes. Then read across to see the investment characteristics to look for, what the tradeoffs are, and the types of investments that are appropriate based on different time horizons. To see if your current investments fall into these categories, enter the value of each of your current assets on the right. Remember to include bank accounts, IRAs, and pensions (etc.) Rethink your investments periodically Most people should make a practice of reviewing their goals and investments once a year. You'll probably also want to review you plan breifly every time you make an investment. As your circumstances change, you may also want to change your strategy. Reviewing and revising your answers to questions 1-5 can help you make appropriate alterations in your investing framework. In the end, all the principles boil down to three simple rules:

We hope that you find this information useful as you plan your investments. If you would like other information -- such as help with retirement planning,

college planning, tax-free investing, or risk management -- please call anytime.

Our experienced representatives are always available. (Investor profiles, fund descriptions and BRC follow) |